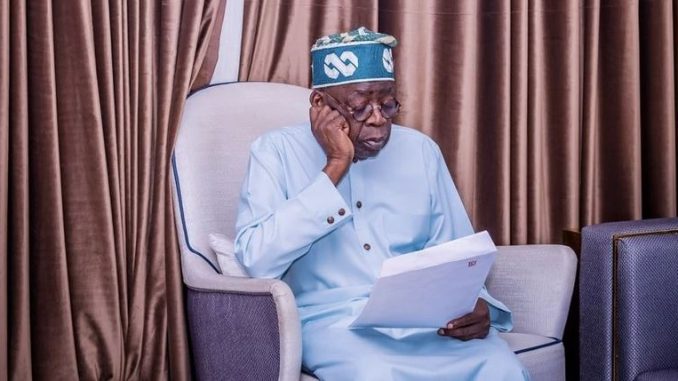

Tinubu writes Emefiele Over Naira Scarcity, Suggests Solutions for CBN.

- Tinubu listed several ways the CBN could manage the crisis caused by the controversial Naira Redesign policy.

With the 2023 general elections barely two weeks away, the Presidential Candidate of the All Progressives Congress, APC, Bola Ahmed Tinubu, has written an open letter on the current Naira Scarcity plaguing the Country.

Tinubu, in the letter, listed several ways the Apex bank could manage the crisis caused by the controversial Naira Redesign policy.

The full letter reads:

“The past few weeks have been a challenging one for Nigerians, especially our SMEs, poor and vulnerable masses, and those whose very survival depends on daily cash transactions. They have felt the brunt of the combined problems of scarcity of fuel and new Naira notes.

“We feel the pains of our market women and artisans who have experienced low sales because customers do not have the cash to make purchases. We hear the loud cries of farmers in rural areas and hinterlands who have been forced to sell their produce at much lower prices so they don’t lose out completely. We hear every Nigerian dealing with the consequences of the roll-out of the cash swap program.

“While the scarcity arising from the supply limitations of the new naira notes is still with us, we are encouraged by reports that the fuel queues across the country are easing out as a result of better supply to fuel stations. We are now confronted with how to bring quick, sustainable solutions and relief to Nigerians on the challenges still posed by the non-availability of new Naira notes so that social and economic activities can move on unimpeded and normalcy can immediately return to our financial services sector and overall productivity of our nation.”

“In seeking a quick resolution, the National Council of State met on Friday, February 10, 2022, and advised the government and Central Bank in particular, to push more new Naira notes into circulation and also allow for the old notes to remain a legal tender by ensuring supply gaps relative to infrastructural limitations are bridged by recirculating it to ameliorate the pains caused by the scarcity of new ones.

“We agree with the wisdom of the Council of States as a necessary starting point to begin redressing the unintended consequences of what would have otherwise been a good policy that required mainstream adoption. For the records, I and my running mate, Senator Kashim Shettima, and our campaign council do not have anything against the CBN Naira redesign and cashless policy in principle. We are, however, only concerned about its disruptive implementation and the hardship it has brought on the generality of our people who currently can’t access their hard-earned money to meet obligations and the attendant consequences on the informal sector, where the majority operate.”

“Despite the challenges and current difficulties, we are a country of resilient, bold, and courageous people who don’t succumb to hard times. We have always overcome our most difficult times and come out better as a people and a nation. This time will not be different. We will make lemonade out of our current lemons.

“To bring immediate relief to our people, we urge the Central Bank to consider the following:

1. Following the advice of the Council of States, the CBN should announce that the old and new Naira notes (especially the non-withdrawn notes and coins) will co-exist as legal tender for the next 12 months to follow examples of countries that have successfully implemented similar monetary policy. This will immediately remove growing tension in the country, eliminate panic reactions by the populace and allow time to scale up infrastructural gaps around alternative payment options to cash.

2. We advise the immediate suspension of associated charges on online transactions and bank transfers and payments via POS until the current crisis is fully resolved. This cost should be considered a roll-out expense by the CBN to incentivize the envisaged shift to alternative transaction channels; for both the financial services consuming the public and those in charge of implementing the scale-up program.

Headquarters of the Central Bank of Nigeria (CBN)

3. Mobilise all Money Deposit Banks, Payment platforms to show clear commitment and timelines on expanding their infrastructure and support services.

4. Bring in Fintech companies with capabilities into the currency swap program for the next 90 days to help decongest banking halls and ATM points where people line up for hours.

5. The Central Bank and other relevant MDAs should form an Inter-Agency Action Committee for immediate oversight over the cash supply gaps from the Nigerian Security and Minting Company and deal with issues around capabilities and turn around time to meet the needs of the informal sector and unbanked people.

6. The CBN, National Orientation Agency and Ministry of Information, State and Local Governments with their relevant organs in both the public and private sectors should commence a major public enlightenment and sensitization campaign to further educate and empower our people on the new naira and cashless policy for better understanding and mainstream adoption.

“As leaders, our commitment to our country every day must be on how to make life better for our people and we are called upon not to waste the opportunity the moment presents to us to ramp up capacity and capability to serve 200 million Nigerians, leaving no one behind and ultimately improve the living conditions of every single Nigerian. Our task now is to restore hope in the country by implementing these steps to energize our people that we can do big things for a better future and shared prosperity. We can build upon this citizen-focused policy challenge to offer a template on how governance should work for the people.

“God bless you and God bless Nigeria. We are overcomers.”

Meanwhile: The Central Bank of Nigeria (CBN) has said that the new naira notes are not targeted at individuals or groups as it has been insinuated.

This was even as they encouraged Nigerians to embrace alternative payment channels such as eNaira and internet banking in the face of the cashless policy.

Source | Pulse

Leave a Reply